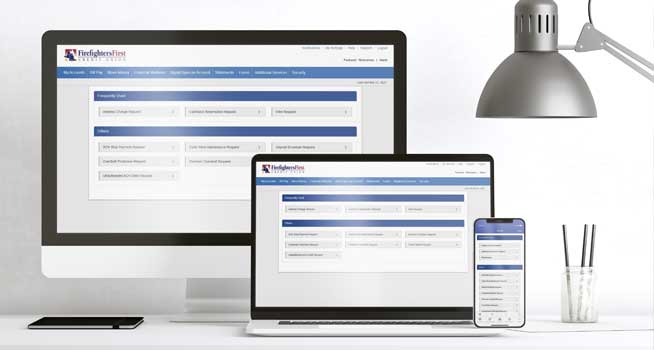

Forms

Get quick access to common service requests using online banking or the FireFirstCU app on your mobile device.

Service on Your Hours, not Bank Hours

We make it very easy to complete a form and submit it yourself—whenever you want, without talking to anyone. However, if you prefer, you can complete your request with the help of a Member Advisor, call our Virtual Branch at 800-231-1626, Monday – Friday, 6:00 AM – 4:30 PM PT.

The FireFirstCU Mobile App

- Log in to the mobile app.

- Select More from the bottom navigation bar.

- Select Self Service Forms from the top navigation bar.

- Select your service request from the list and complete the form.

Online Banking

- Log in to your online banking account.

- Select Self Service Forms from the top navigation bar.

- Select your service request from the list and complete the form.

Self-Service Tools

If you’re not up-to-date with us, we can’t stay up-to-date with you. Use the form to update any contact information, including your email address and phone number.

Redeem up to the full amount of available rewards on your Visa® credit and debit cards. We will deposit your cashback funds into your checking or savings account within 2 business days of submitting the form.

Request a domestic Wire Transfer1 by 1:00 PM PT on weekdays and get it processed the same day. You’ll find this helpful when you need to wire funds to close escrow. Requests on weekends and holidays go through the next business day.

1Domestic wires only. For business accounts, one free wire transfer allowed per month. Cut-off time will be at 1:00 p.m. PT (Pacific Time) on each weekday that the Credit Union is open excluding holidays. Payment orders, cancellations, or amendments received after the applicable cut-off time may be treated as having been received on the next funds transfer business day and processed accordingly.

An ACH debit is an authorized electronic funds transfer. For example, when you set up recurring monthly payments for a mortgage or utility bill. An ACH debit takes funds from your bank account automatically. An ACH Stop Payment will prevent a pending payment from posting to your account.

Change a code word you have established for your member accounts.

Save time at ATMs that require envelopes.

Protect yourself from overdrawing a checking account. Avoid the high fees and potential reporting associated with a returned check when you enroll in overdraft protection.

Give yourself extra protection from overdrawing a checking account. In addition to avoiding the high fees and potential reporting associated with a returned check, you expand overdraft limits to cover multiple transactions.

For complete details and restrictions, click here.

A travel notice makes using your card outside the U.S. smooth and hassle-free for all the Firefighters First cardholders in your family. Enter your itinerary by country and the dates of your stay.

An ACH debit is an authorized electronic funds transfer. For example, when you set up recurring monthly payments for a mortgage or utility bill. An ACH debit takes funds from your bank account automatically. An unauthorized debit transaction can be an ACH debit that was not authorized, a transaction in an amount different from what was authorized or a transaction initiated earlier than requested.