Retirement Planning

Start planning for a more financially secure retirement. MoneyGuidePro®* can help.

Create Your Personalized Retirement Plan

Retirement can mark the beginning of a new adventure. Do you want to start a business? Travel? Invest in real estate? Golf every day? MoneyGuidePro will help you shape a financial plan, so that when the time comes, you’ll be ready for your new adventure.

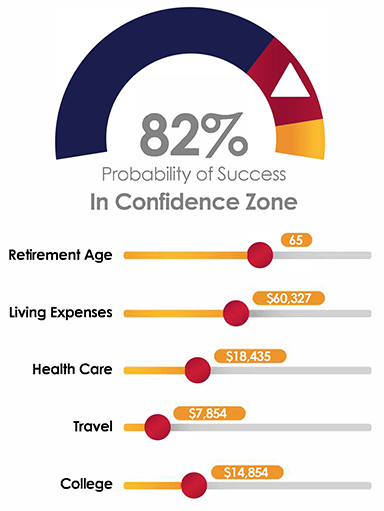

MoneyGuidePro® helps you identify the things you want to afford in retirement and budgets them on an easy-to-understand dashboard:

- Living expenses

- Healthcare

- Travel

- College expenses for your children

Compare what you want to spend, to what you’re on track to earn, and you’ll get a Confidence Zone score.

Make changes to your plan—such as raising your retirement age—and watch your Confidence Zone score go up.

Ready to Get Started?

Learn more about how MoneyGuidePro can help you manage all of life’s big financial decisions and achieve your long-term goals.

- Watch the video to learn more about the benefits of financial planning

- Visit the MoneyGuidePro page

- View the retirement brochure and see the Confidence Zone dashboard in action

- See how your financial plan will look. View a sample retirement plan

Tax-Smart Retirement Income for You and Your Business

An investment strategy helps you sleep better knowing you will be able to enjoy your retirement. We can help you build savings in a tax-advantaged retirement account to supplement a pension or consolidate existing accounts you may have. So, when you make the transition to retirement, you’ll be ready to turn your savings into an income stream.

IRAs offer tax advantages to encourage you to save for your retirement. There are different IRAs for different financial situations.

Types of IRAs:

|

|

Use our IRA Options Calculator to find out the maximum amount you can contribute. It will also help you determine if you are eligible to contribute to both Traditional and Roth IRAs.

Just tell us a little about your business. We’ll simplify choosing the right plan for your situation.

Types of 401(k)s:

|

|

Schedule a Meeting

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Firefighters First Credit Union and Firehouse Financial are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Firehouse Financial, and may also be employees of Firefighters First Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Firefighters First Credit Union or Firehouse Financial. Securities and insurance offered through LPL or its affiliates are:

Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

* © MoneyGuide, Inc. Reproduced with Permission. All rights reserved.